See, Control, and Automate Your Treasury.

Omnitrove unifies your banks, wallets, and exchanges into one secure dashboard for real-time visibility and automated control of every asset.

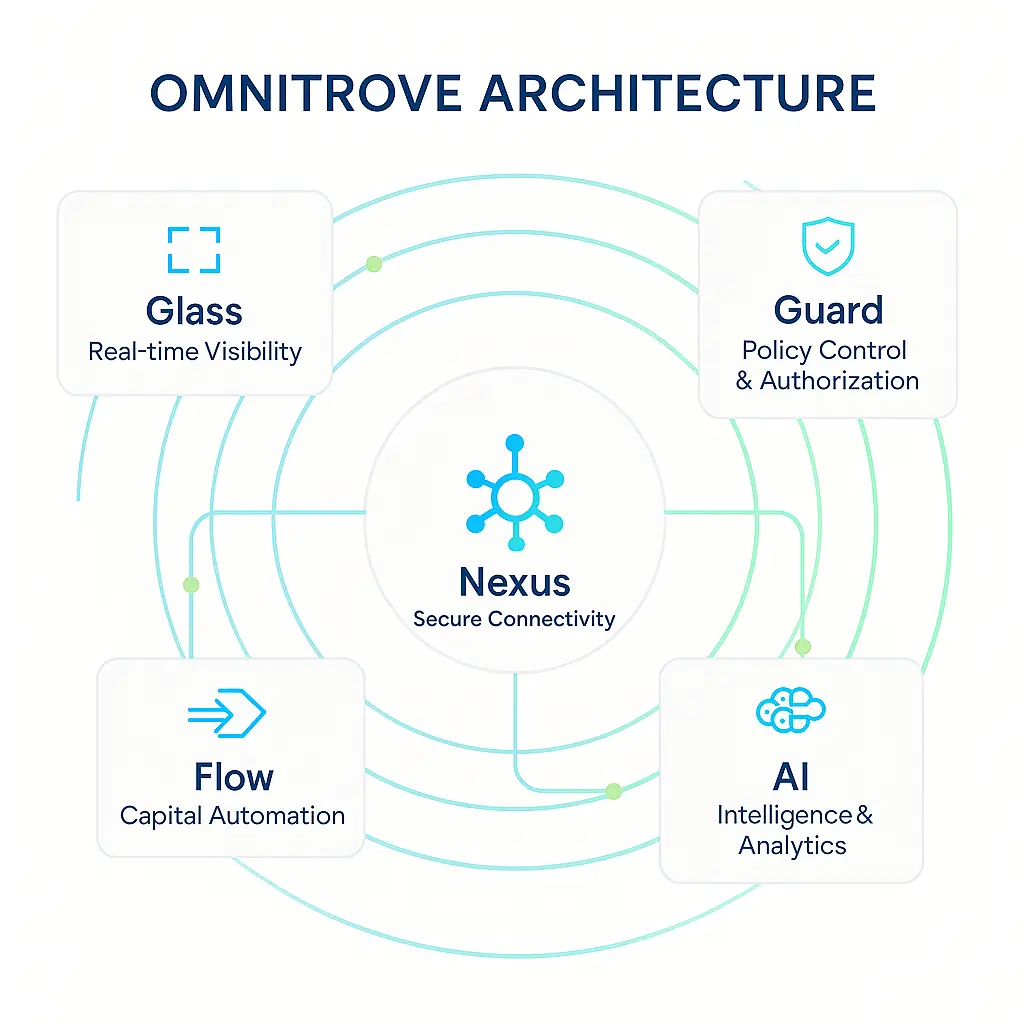

Omnitrove Architecture

Built for visibility, control, and precision.

Omnitrove is structured in five connected layers, each designed to simplify how financial data moves between systems. From secure connectivity to automated intelligence, every module plays a specific role in creating a seamless, auditable treasury workflow.

- Glass

- See every account and balance across banks, exchanges, and blockchains in real time, all from one secure dashboard.

- Guard

- Define clear approval rules and multi-party permissions to keep treasury operations secure and compliant.

- Nexus

- Powers all API, blockchain, exchange, and bank integrations, this connective core unifies fragmented financial systems into a single network of verified data.

- Flow

- Move fiat or digital assets safely between systems with automated approval flows and real-time confirmation.

- AI

- Leverage AI to forecast cash flow, detect irregular activity, and anticipate liquidity needs before they arise.

Omnitrove Roadmap

From real-time visibility to governed automation to AI-optimized treasury

1.0 See Everything

- Unified exchanges, banks, wallets

- Read access to all accounts

- Transaction history & exports

- Multi-currency (USD / CAD)

1.1 Control Everything

- Cross Border Transfer Integration

- Move funds across bank, CEX, chain

- Batch & recurring payments

- On/Off-ramp partner connectivity

1.2 Optimize Everything

- Approval workflows (RBAC, multi-sig)

- AI cash flow forecasting

- Off-exchange support

- Integrate Market Leading HR Suite

2.0 Collaborate Everywhere

- AI Support Chatbot

- AI MCP Finance Team Server

- Additional Chains & Countries

- Smart liquidity routing

3.0 Automate Intelligently

- Algorithmic Treasury Forecasting

- Agent Based Financial Reports

- AI-Powered Treasury Optimization

- Support for DeFi Staking

4.0 Lead with Intelligence

- Fractional CFO-as-a-Service

- Liabilities & equities integration

- Payroll Integration

- Developer SDK and API

Supported banks, exchanges, and blockchains

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='Your_design'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='632.014px'%20height='126.611px'%20viewBox='0%200%20632.014%20126.611'%20enable-background='new%200%200%20632.014%20126.611'%20xml:space='preserve'%3e%3cpolygon%20fill='%23F3BA2F'%20points='38.171,53.203%2062.759,28.616%2087.36,53.216%20101.667,38.909%2062.759,0%2023.864,38.896%20'/%3e%3crect%20x='3.644'%20y='53.188'%20transform='matrix(0.7071%200.7071%20-0.7071%200.7071%2048.7933%208.8106)'%20fill='%23F3BA2F'%20width='20.233'%20height='20.234'/%3e%3cpolygon%20fill='%23F3BA2F'%20points='38.171,73.408%2062.759,97.995%2087.359,73.396%20101.674,87.695%20101.667,87.703%2062.759,126.611%2023.863,87.716%2023.843,87.696%20'/%3e%3crect%20x='101.64'%20y='53.189'%20transform='matrix(-0.7071%200.7071%20-0.7071%20-0.7071%20235.5457%2029.0503)'%20fill='%23F3BA2F'%20width='20.234'%20height='20.233'/%3e%3cpolygon%20fill='%23F3BA2F'%20points='77.271,63.298%2077.277,63.298%2062.759,48.78%2052.03,59.509%2052.029,59.509%2050.797,60.742%2048.254,63.285%2048.254,63.285%2048.234,63.305%2048.254,63.326%2062.759,77.831%2077.277,63.313%2077.284,63.305%20'/%3e%3cpath%20fill='%23F3BA2F'%20d='M148.37,30.679h31.117c7.723,0,13.563,1.982,17.521,5.946c3.063,3.07,4.594,6.875,4.594,11.414v0.192%20c0,1.918-0.237,3.613-0.714,5.083c-0.476,1.472-1.112,2.797-1.907,3.98c-0.793,1.184-1.715,2.223-2.763,3.117%20c-1.049,0.896-2.176,1.664-3.383,2.302c3.882,1.472,6.938,3.469,9.166,5.995c2.227,2.527,3.342,6.028,3.342,10.503v0.191%20c0,3.07-0.59,5.755-1.771,8.058c-1.181,2.301-2.873,4.22-5.076,5.755c-2.203,1.535-4.852,2.685-7.948,3.453%20c-3.096,0.767-6.527,1.15-10.292,1.15H148.37V30.679z%20M176.376,57.822c3.262,0,5.852-0.558,7.769-1.678%20c1.918-1.119,2.877-2.926,2.877-5.419v-0.192c0-2.237-0.832-3.947-2.494-5.131c-1.663-1.183-4.061-1.775-7.193-1.775h-14.579v14.195%20H176.376z%20M180.309,84.871c3.261,0,5.817-0.59,7.673-1.774c1.854-1.183,2.782-3.022,2.782-5.516V77.39%20c0-2.238-0.864-4.012-2.59-5.324c-1.727-1.309-4.508-1.965-8.345-1.965h-17.073v14.771H180.309z'/%3e%3cpath%20fill='%23F3BA2F'%20d='M223.875,30.679h14.772v67.141h-14.772V30.679z'/%3e%3cpath%20fill='%23F3BA2F'%20d='M261.02,30.679h13.618l31.461,41.34v-41.34h14.579v67.141h-12.564l-32.516-42.682v42.682H261.02V30.679z'/%3e%3cpath%20fill='%23F3BA2F'%20d='M365.398,30.2h13.619l28.776,67.62H392.35l-6.139-15.058h-28.391l-6.138,15.058h-15.061L365.398,30.2z%20M380.936,69.716l-8.921-21.772l-8.918,21.772H380.936z'/%3e%3cpath%20fill='%23F3BA2F'%20d='M423.738,30.679h13.621l31.459,41.34v-41.34h14.579v67.141h-12.564l-32.516-42.682v42.682h-14.579V30.679z'%20/%3e%3cpath%20fill='%23F3BA2F'%20d='M536.557,98.97c-4.926,0-9.496-0.896-13.717-2.685s-7.865-4.236-10.934-7.338%20c-3.07-3.101-5.469-6.762-7.193-10.982c-1.727-4.221-2.59-8.729-2.59-13.525v-0.191c0-4.796,0.863-9.287,2.59-13.476%20c1.725-4.188,4.123-7.865,7.193-11.03c3.068-3.165,6.746-5.66,11.029-7.482s9.018-2.733,14.197-2.733%20c3.131,0,5.992,0.257,8.582,0.767c2.59,0.513,4.939,1.215,7.051,2.11c2.111,0.896,4.059,1.983,5.852,3.261%20c1.787,1.28,3.451,2.686,4.986,4.221l-9.398,10.838c-2.625-2.365-5.293-4.221-8.01-5.563c-2.719-1.342-5.771-2.014-9.16-2.014%20c-2.814,0-5.42,0.544-7.816,1.631c-2.398,1.087-4.461,2.589-6.188,4.507c-1.725,1.918-3.068,4.141-4.029,6.666%20c-0.957,2.527-1.436,5.228-1.436,8.105v0.191c0,2.877,0.479,5.596,1.436,8.152c0.961,2.559,2.285,4.796,3.982,6.714%20c1.693,1.918,3.74,3.438,6.137,4.557c2.4,1.12,5.037,1.678,7.914,1.678c3.838,0,7.08-0.703,9.734-2.11%20c2.654-1.405,5.293-3.324,7.914-5.755l9.4,9.496c-1.727,1.855-3.52,3.518-5.371,4.987c-1.855,1.472-3.885,2.734-6.092,3.79%20c-2.205,1.054-4.621,1.855-7.24,2.397C542.756,98.697,539.816,98.97,536.557,98.97z'/%3e%3cpath%20fill='%23F3BA2F'%20d='M581.467,30.679h50.547v13.141h-35.967v13.62h31.652v13.14h-31.652v14.1h36.449v13.14h-51.029V30.679z'/%3e%3c/svg%3e)

+100s more

Frequently asked questions

- Unified visibility across all asset types and accounts

- Automated reconciliation that reduces manual workload and audit risk

- Policy-based controls for governance and compliance

- Liquidity forecasting and optimization tools to improve capital deployment

- AI-driven insights that turn treasury data into proactive financial strategy

- Nexus: Connects financial data across banks, custodians, and blockchain networks.

- Glass: Provides real-time visibility and analytics for balances, liquidity, and exposures.

- Guard: Handles security, governance, and approval workflows.

- Flow: Automates settlements, transfers, and capital movements.

- AI: Delivers forecasting, optimization, and anomaly detection. Together, these modules create a unified treasury management system that adapts to any institution’s structure and risk profile.

- exSat Digital Bank for digital asset banking, yield, and collateral management

- 1DEX for institutional-grade decentralized exchange access and liquidity routing

- Platform rebates for organizations that stake $A to reduce fees and unlock premium features & services

- Incentive programs for participants who contribute data, liquidity, or network activity

- Major blockchain networks: 25+ blockchain networks including Bitcoin (BTC), Vaulta ($A), Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and Binance Chain (BNB).

- Exchanges: Coinbase, Binance, Kraken, OKX, and Bybit

- Banks: Support for institutions in the United States and Canada

- Accounting systems: Planned integrations with QuickBooks, Gusto, and NetSuite

- Institutional-grade governance and control mechanisms

- Multi-source data connectivity across fiat and on-chain accounts

- AI-driven forecasting and intelligent automation

- Future blockchain-level verification through Vaulta